Gas Insulated Switchgear (GIS) Market Overview

Gas Insulated Switchgear (GIS) is a type of electrical switchgear that uses sulfur hexafluoride (SF6) gas to insulate electrical components such as circuit breakers, disconnectors, and transformers. GIS is widely used in high-voltage applications where space constraints, reliability, and safety are crucial. Due to its ability to function effectively in compact spaces and harsh environmental conditions, GIS technology is favored for urban infrastructure, substations, and other critical power applications.

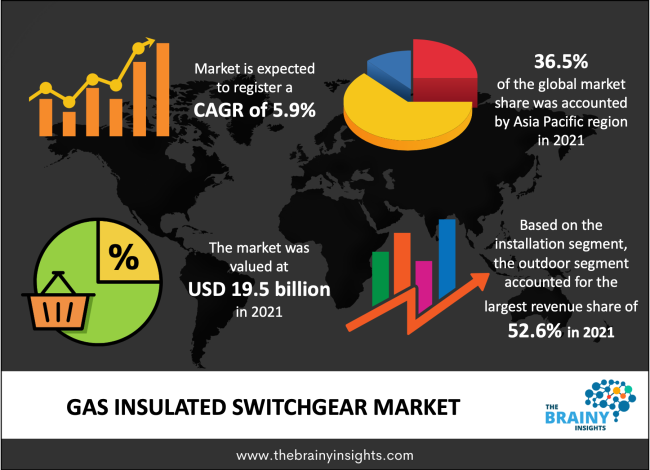

The gas insulated switchgear market was valued at approximately USD 19.5 billion in 2021 and is expected to grow at a CAGR of around 5.9% from 2022 to 2030. By 2030, the market is projected to reach nearly USD 32.6 billion.

The GIS market has been experiencing steady growth due to increasing demand for reliable and efficient electrical power infrastructure, especially in developing countries. Additionally, the shift towards renewable energy sources and the modernization of existing electrical grids are further boosting the market.

Market Dynamics

Drivers:

- Increasing Demand for Efficient Power Distribution: GIS offers high reliability, safety, and space efficiency, which are vital for ensuring the stability of power grids.

- Urbanization and Infrastructure Development: As cities grow and infrastructure becomes more complex, there is a higher need for compact and reliable power solutions.

- Shift to Renewable Energy: The integration of renewable energy sources into power grids requires advanced switchgear systems like GIS that can manage the variability and complexity of renewable power.

Restraints:

- High Initial Investment: The cost of GIS systems can be higher compared to air-insulated switchgear (AIS), which might restrict adoption, especially in cost-sensitive markets.

- SF6 Gas Concerns: SF6, the primary insulating gas used in GIS, is a potent greenhouse gas. Regulatory pressure to reduce SF6 emissions may impact market growth.

Opportunities:

- Technological Advancements: Ongoing research into alternative insulating gases and more efficient GIS technologies can open new opportunities in the market.

- Grid Modernization Initiatives: Many countries are modernizing their power grids, which presents a significant opportunity for GIS systems.

Challenges:

- Regulatory Compliance: Meeting environmental regulations concerning SF6 emissions and finding suitable alternatives is a key challenge for GIS manufacturers.

Regional Analysis

- North America: The GIS market in North America is driven by the demand for upgraded and smart grid technologies. Additionally, investments in renewable energy are promoting the need for GIS solutions in power infrastructure.

- Europe: Europe is a key market for GIS due to stringent environmental regulations and a focus on reducing carbon emissions. The adoption of GIS is expected to increase in countries like Germany, the UK, and France.

- Asia-Pacific: The Asia-Pacific region is the largest market for GIS, with significant demand from countries like China, India, and Japan. Growing urbanization and industrialization are pushing the demand for GIS systems in this region.

- Middle East & Africa: The Middle East is experiencing substantial demand for GIS due to the need for reliable power systems in extreme climates. Africa is gradually adopting GIS due to the growing need for better power infrastructure.

- Latin America: Latin America is focusing on upgrading its aging infrastructure, and GIS technology is seen as an essential part of this modernization effort.

Segmental Analysis

- By Voltage Level:

- High Voltage (HV): Typically used for grid substations and large industrial applications.

- Medium Voltage (MV): Ideal for urban infrastructure and industrial power distribution systems.

- By Application:

- Utility: GIS systems are widely used in electrical utilities for grid management and fault isolation.

- Industrial: Industrial applications require high-reliability power systems, making GIS a favored solution.

- Commercial: For data centers and large commercial buildings, GIS provides space-saving and reliable power distribution.

- By End-User:

- Power Generation: GIS plays a crucial role in power generation plants.

- Power Transmission: High-voltage GIS is widely used in the transmission sector for managing the grid.

- Power Distribution: GIS is essential for distribution networks to ensure high availability and reliability.

List of Key Players

- Siemens AG

- Schneider Electric

- General Electric (GE)

- ABB Ltd.

- Mitsubishi Electric Corporation

- Eaton Corporation

- Hitachi, Ltd.

- Hyundai Electric & Energy Systems Co., Ltd.

- Toshiba Corporation

- CG Power and Industrial Solutions Ltd.

Key Trends

- Adoption of Environmentally Friendly Technologies: Manufacturers are focusing on reducing the environmental impact of GIS, including researching alternatives to SF6.

- Compact and Modular Designs: Smaller, more flexible GIS systems are being developed to meet the needs of modern infrastructure, especially in urban environments.

- Integration with Smart Grid Technologies: GIS is increasingly integrated with digital technologies, enabling remote monitoring, fault detection, and real-time data analysis.

Request PDF Brochure: https://www.thebrainyinsights.com/enquiry/sample-request/13179

Conclusion

The Gas Insulated Switchgear market is poised for growth driven by urbanization, infrastructure development, and the need for more efficient power distribution. While high initial costs and environmental concerns remain challenges, the market's future is bright, particularly with technological advancements and the increasing demand for renewable energy integration. The GIS market is set to thrive with continued innovations and improvements in system efficiency and environmental impact.