Introduction to Premium Wine

Premium wine refers to higher-quality wine products, typically crafted from select vineyards, using meticulous fermentation processes and aged with precision. While pricing varies by region, premium wine generally sits above mass-market brands, with super-premium, ultra-premium, and luxury tiers offering a refined drinking experience.

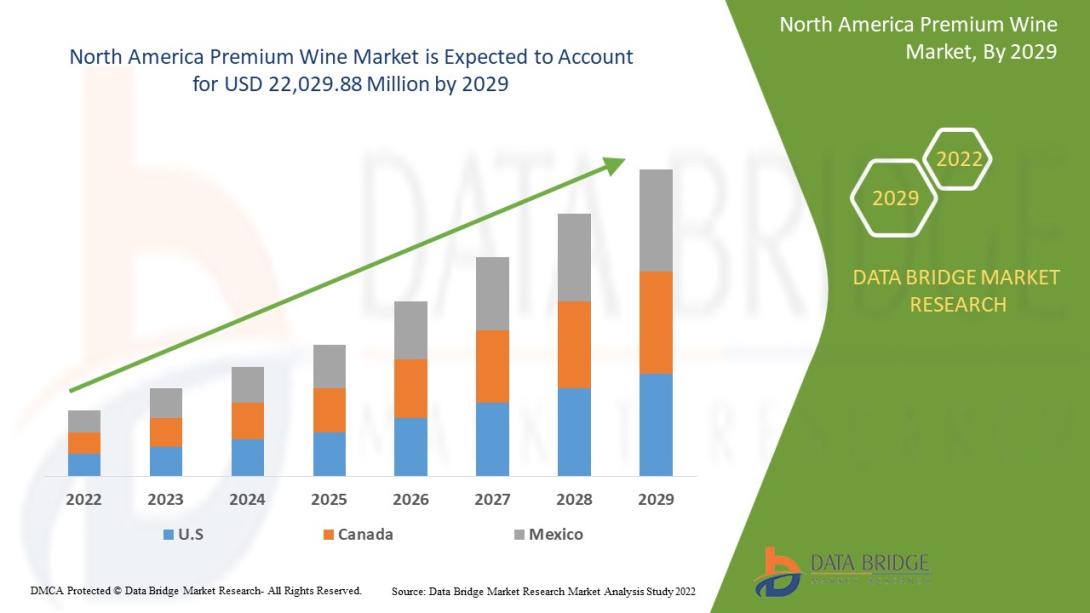

In North America, particularly the U.S. and Canada, premium wine consumption is booming—fueled by rising affluence, cultural shifts, and a growing appreciation for sustainably made, artisanal beverages.

Market Overview

The North America premium wine market is valued at USD 18.4 billion in 2024, projected to reach USD 27.9 billion by 2030, growing at a CAGR of 7.2%. This growth reflects shifting preferences toward quality over quantity, with consumers favoring boutique brands, regional authenticity, and online wine discovery platforms.

Regions like California, Oregon, British Columbia, and Ontario lead production, while urban consumers across the U.S. and Canada drive demand for personalized, health-conscious, and aesthetically appealing wines.

Key Market Drivers

1. Sophisticated Lifestyles and Disposable Income

North American consumers, especially urban dwellers, are increasingly investing in high-end dining and lifestyle experiences, where premium wine enhances the moment.

2. Direct-to-Consumer (DTC) Growth

Digital transformation allows wineries to sell directly to consumers, bypassing distributors and building brand loyalty through subscriptions and online stores.

3. Millennial and Gen Z Wine Enthusiasts

Younger consumers prefer craftsmanship, storytelling, and ethical sourcing over traditional luxury cues—helping small, premium producers thrive.

4. Organic and Biodynamic Demand

Health-conscious drinkers seek natural, additive-free wines with eco-friendly packaging and carbon-neutral certifications.

Market Restraints and Challenges

- Price Sensitivity: Even premium buyers are value-driven, making pricing a delicate balance.

- Alcohol Alternatives: The rise of craft beer, hard seltzer, and non-alcoholic options competes with traditional wine.

- Climate Risks: Wildfires, droughts, and temperature shifts threaten grape yields and quality, especially in California.

- Alcohol Regulation: Complex licensing laws and varying state policies challenge interstate and cross-border sales.

Market Segmentation

By Type:

- Red Wine: Dominates in value and volume (Cabernet, Pinot Noir, Merlot)

- White Wine: Chardonnay, Sauvignon Blanc, and Riesling rising in popularity

- Rosé and Sparkling: Trending with younger demographics and seasonal drinkers

By Price Tier:

- Super Premium: $15–$25 per bottle

- Ultra Premium: $25–$50

- Luxury: $50+ (cult wines and reserve vintages)

By Distribution:

- On-Trade: High-end restaurants, hotels, wine bars

- Off-Trade: Liquor stores, supermarkets, wine boutiques

- Online: Winery websites, wine apps, e-retailers (Vivino, Wine.com)

Premium Wine Consumer Trends

- Storytelling and Provenance: Labels that highlight vineyard history, winemaker ethos, and climate details appeal to discerning buyers.

- Low-Intervention Wines: Unfiltered, natural fermentation methods gain fans among authenticity-seeking consumers.

- Design and Packaging: Minimalist, eco-conscious packaging and label personalization are enhancing shelf appeal.

- Food and Wellness Pairings: Premium wines are marketed with culinary experiences, plant-based meals, and moderate lifestyle branding.

Role of E-Commerce and Wine Subscriptions

Online sales have reshaped wine retail, offering:

- Virtual tastings and somm-led experiences

- Tailored recommendations using AI

- Flexible monthly subscriptions from curated wine clubs

- Enhanced delivery logistics and tracking for perishable goods

Post-COVID, even traditional consumers are now comfortable purchasing premium wine online.

Key Regional Markets

California

Home to Napa and Sonoma, California is synonymous with luxury cabernets, chardonnays, and cult wines. Sustainable farming and wildfire recovery dominate the conversation.

Oregon & Washington

Known for Pinot Noir and Riesling, Oregon offers terroir-driven wines, while Washington emphasizes volume with premium value, especially from the Columbia Valley.

Canada

British Columbia’s Okanagan Valley and Ontario’s Niagara Peninsula are gaining global recognition for cool-climate varietals, sparkling wines, and Icewines. Wineries here focus heavily on eco-certifications and local tourism.

Leading Brands and Wineries

- E. & J. Gallo Winery: Owns luxury labels like Orin Swift and Louis M. Martini

- Constellation Brands: Holds Robert Mondavi, Meiomi, and Kim Crawford

- Jackson Family Wines: A portfolio of artisan-focused, family-owned vineyards

- The Wine Group: Mid-to-premium range with expanding DTC services

- Vintage Wine Estates: Acquires and promotes boutique wineries for direct retail

Technological Innovations

- AI for Vineyard Monitoring: Analyzes weather and crop data to optimize yield

- Blockchain: Ensures provenance tracking and fraud prevention

- Smart Labels: QR codes linking to virtual tasting notes and vineyard tours

Sustainability in Premium Wine

Eco-conscious wine production is not a trend—it’s a requirement:

- Organic/Biodynamic Certifications: Now standard in many boutique operations

- Water Conservation and Soil Management: Key in drought-prone regions

- Reusable Bottles and Lightweight Packaging: Help reduce shipping footprint

- Carbon-Neutral Initiatives: Many brands are aiming for net-zero emissions

Regulatory Environment

- U.S. TTB (Alcohol and Tobacco Tax and Trade Bureau): Oversees labeling and production rules

- Canada’s LCBO and provincial boards: Regulate distribution and pricing

- AVAs and VQAs: Protect appellation designations like Napa Valley, Willamette Valley, and Okanagan Valley

- Tariff Fluctuations: Trade policies impact import/export dynamics with Europe and Asia

Future Opportunities and Trends

- Wine Tourism Revival: Experiential travel focused on vineyard stays, food pairing events, and harvest participation

- Global Expansion: U.S. and Canadian premium labels tapping into Asia and Europe markets

- Canned and Low-ABV Premium Wines: Gaining traction with health-conscious drinkers

- Inclusive Winemaking: More women, BIPOC, and LGBTQ+ vintners entering and reshaping the industry

SWOT Analysis

Strengths:

- High-margin products with loyal customer base

- Strong storytelling and terroir branding

- DTC and e-commerce growth

Weaknesses:

- Vulnerable to climate volatility

- Distribution complexities in North America

- Aging consumer base for traditional wines

Opportunities:

- Younger audience engagement

- Diversification of product formats (cans, spritzers)

- Technological traceability and sustainability leadership

Threats:

- Competitive alcohol alternatives

- Regulatory hurdles and state-level barriers

- Supply chain issues from extreme weather

Conclusion

The North America premium wine market is at the intersection of tradition and innovation. As consumers seek authentic, ethically produced, and flavorful wines, the market offers immense growth potential—from vineyard-to-glass tech integration to online subscriptions and inclusive branding.

With a focus on quality, storytelling, and sustainability, the region is redefining what premium wine means in the modern era—making it not just a drink, but an experience.

Get More Details : https://www.databridgemarketresearch.com/reports/north-america-premium-wine-market

Get More Reports :

https://www.databridgemarketresearch.com/reports/global-cloud-virtual-mobile-infrastructure-market

https://www.databridgemarketresearch.com/reports/global-clean-labelling-market

https://www.databridgemarketresearch.com/reports/global-bovine-colostrum-market

https://www.databridgemarketresearch.com/reports/global-multifactor-authentication-market

https://www.databridgemarketresearch.com/reports/global-micromachining-market