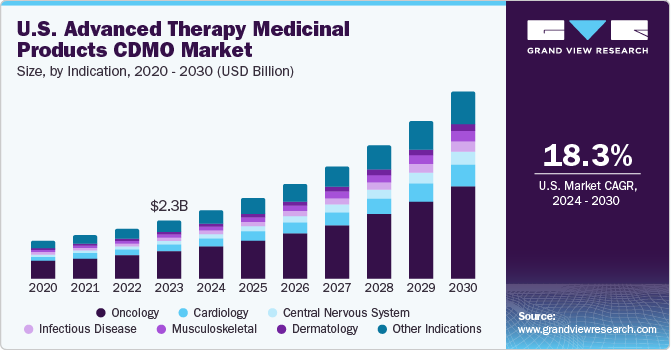

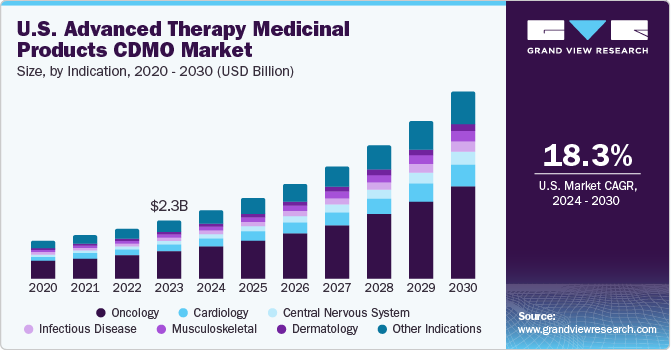

The U.S. market for Advanced Therapy Medicinal Products (ATMPs) CDMOs was valued at an estimated USD 2.34 billion in 2023 and is projected to surge at a compelling compound annual growth rate (CAGR) of 18.29% from 2024 to 2030. This impressive growth is largely driven by the increasing incidence of rare and severe diseases, significant investments flowing into ATMP research and development (R&D), and the expanding trend of outsourcing within the pharmaceutical sector. The inherent complexity of manufacturing ATMPs, coupled with a growing need for specialized expertise and advanced technologies, has fueled the demand for CDMO (Contract Development and Manufacturing Organization) services. These organizations play a vital role in facilitating the development and successful commercialization of innovative therapies, thereby significantly contributing to market expansion.

In 2023, the U.S. ATMP CDMO market commanded the largest share, holding over 40% of the global market. This leadership position is propelled by a rising number of ATMP clinical trials, the increasing adoption of advanced therapies, and a surge in outsourcing activities. Technological innovation and enhanced manufacturing capabilities by biotech companies are creating new commercial opportunities for market growth. Recent product approvals have accelerated R&D efforts in this cutting-edge field. Furthermore, a consistent flow of funds and grants has led to a proliferation of ATMP clinical trials, with non-commercial entities like universities also sponsoring ongoing trials to expedite their progress.

Get a preview of the latest developments in the U.S. Advanced Therapy Medicinal Products CDMO Market; Download your FREE sample PDF copy today and explore key data and trends

Outsourcing activities in the ATMP domain are on the rise because they enable companies to acquire crucial competencies for the successful development and commercialization of these complex therapies. Outsourcing offers extended expertise, better management of cash flows, and significant manufacturing advantages, including risk reduction. The low incidence-to-prevalence ratio for genetic and rare diseases makes outsourcing a particularly favorable alternative. Building in-house facilities for single gene therapies requires rapid cost recovery, making outsourcing an effective strategy until market demand becomes firmly established. Additionally, a limited understanding of the final scale requirements for current and future products further supports the preference for outsourcing.

Public awareness about ATMP treatment options is also increasing, thanks to initiatives aimed at informing people about their benefits. This, in turn, is leading to greater adoption of advanced therapies and fueling market growth for CDMOs. For example, in May 2021, OVID Health launched the Cell and Gene Collective, with support from major companies like Astellas, bluebird bio, Kite, Bristol Myers Squibb, and Novartis, specifically to raise awareness about cell and gene therapies.

Detailed Segmentation

Product Insights

Gene therapy led the market in 2023 with 49.09% of the total revenue share, driven by increased financial support, clinical trials, and expected commercialization of these products. Early-stage companies facing challenges in generating in-house capabilities are expected to fuel the demand for CDMO services, contributing to the segment’s growth. Collaborative efforts for novel gene therapy development and expanding applications are expected to boost manufacturing prospects in this domain.

Phase Insights

In 2023, Phase I clinical trials dominated the market with revenue share of 50%. These trials were primarily focused on establishing the maximum tolerated dose for patients without adverse effects. Approximately 70% of Phase I drug candidates progress to the next phase. The increasing number of preclinical studies and involvement of small and startup biotechnology and biopharmaceutical companies in R&D activities have led to a rise in demand for CDMOs to conduct Phase I clinical trials. Due to the complex and costly nature of new drug development, companies are outsourcing CDMO services to initiate clinical studies. As emerging biotechnology firms require CDMOs to conduct early-phase trials according to their study requirements, this trend is expected to drive market growth.

Indication Insights

Oncology held the largest revenue share of 45% in 2023 and is anticipated to register the fastest growth over the forecast period. The high number of cancer cases has increased the need for advanced treatments, leading to a big demand for manufacturing services in oncology. Competition among key companies and new treatments have made oncology even more important. As of January 2021, about 18,000 to 19,000 patients could benefit from cell and gene therapies like Kymriah (Novartis AG) and Yescarta (Gilead Sciences, Inc.) for cancer treatment.

Key U.S. Advanced Therapy Medicinal Products CDMO Company Insights

The market is consolidated, driven by the increasing outsourcing activities in the pharmaceutical industry. This consolidation trend is propelled by the need for CDMOs to enhance their capabilities, meet evolving customer demands, and maintain a competitive edge. Companies include Celonic; Bio Elpida; CGT Catapult; Rentschler Biopharma SE; AGC Biologics; and Catalent.

Key companies are adopting market strategies such as collaborations, partnerships, and geographical expansion to increase their market share. For instance, in January 2024, Galapagos NV announced a strategic collaboration with Thermo Fisher Scientific for the decentralized manufacturing of Galapagos’ point-of-care CAR-T product candidate in the San Francisco area. Thermo Fisher provided GMP manufacturing, BioServices, and Specialty Logistics for Galapagos’ CAR-T hemato-oncology clinical program, effective January 2024.

Key U.S. Advanced Therapy Medicinal Products CDMO Companies:

- Celonic

- Bio Elpida

- CGT Catapult

- Rentschler Biopharma SE

- AGC Biologics

- Catalent

- Lonza

- WuXi Advanced Therapies

- BlueReg

- Minaris Regenerative Medicine

- Patheon

U.S. Advanced Therapy Medicinal Products CDMO Market Report Segmentation

Grand View Research has segmented the U.S. advanced therapy medicinal products CDMO market report based on product, phase, and indication.

- Product Outlook (Revenue, USD Million, 2018 - 2030)

- Gene Therapy

- Cell Therapy

- Tissue Engineered

- Other Products

- Phase Outlook (Revenue, USD Million, 2018 - 2030)

- Phase I

- Phase II

- Phase III

- Phase IV

- Indication Outlook (Volume, Units; Revenue, USD Million, 2018 - 2030)

- Oncology

- Cardiology

- Central Nervous System

- Musculoskeletal

- Infectious Disease

- Dermatology

- Endocrine, Metabolic, Genetic

- Immunology & Inflammation

- Opthalmology

- Haematology

- Gasteroenterology

- Other Indications

Curious about the U.S. Advanced Therapy Medicinal Products CDMO Market? Download your FREE sample copy now and get a sneak peek into the latest insights and trends

Recent Developments

- In February 2024, Thermo Fisher Scientific expanded its biologics manufacturing facility in St. Louis, Missouri, U.S., doubling its capacity to produce complex treatments for various diseases. This expansion made the facility the largest single-use technology CDMO in the country.

- In February 2023, Lonza, a global manufacturing partner for the pharmaceutical, biotech, and nutrition industries, announced its plans to expand Early Development Services (EDS) into Cambridge, Massachusetts (U.S.), North America.

- In February 2022, AGC Biologics entered into a supply agreement with Pfizer, Inc. for the supply of plasmid DNA used for development of an Omicron-based vaccine candidate. The first batch of the vaccine was scheduled to be available by the end of March 2022, according to the company.

- In February 2022, Thermo Fisher Scientific, Inc. announced the launch of new integrated commercial packaging and distribution services aimed to help patients in the U.S. and Europe transition from clinic to commercial launch.

- In June 2021, Dendreon Pharmaceuticals, a biopharmaceutical manufacturer of cell therapies, shifted into the CDMO business for late-stage cell therapies to address expertise gaps and rising demand for end-to-end manufacturing.